|

Since they provide an efficient way of obtaining the best prices across several DEXs, decentralized exchange (DEX) aggregators have become a vital resource for cryptocurrency traders. By connecting to several decentralized exchanges, these systems optimize trade execution and pool liquidity to guarantee that consumers receive the best pricing for their transactions. In this article, we will examine the best DEX aggregator among all options available today.

Table of Contents What is a DEX Aggregator?With the help of the blockchain-based DEX Aggregator service, bitcoin traders may profit from various financial tools through a single interface. The acronym DEX stands for Decentralized Exchange, which is based on blockchain technology and offers increased security. To put it simply, DEX aggregators are the financial protocols that enable investors and traders to access several trading pools easily through a single interface. They use an intricate algorithm that considers a number of variables to determine which provider from the different platforms is most suitable for a particular token swap. How does the DEX Aggregator work?DEX aggregators are now a necessary service due to cryptocurrencies gaining popularity and decentralized exchanges gaining traction. In the same way, layer-2 solutions are created on top of blockchains, and DEX aggregators are built on top of the current DEXs. They provide traders access to all accessible markets, order books, and prices across several blockchains from a single entry point. Furthermore, because they are based on advanced algorithms, they may optimize token pricing, slippage, and exchange costs for the advantage of their customers. A DEX aggregator, for instance, functions similarly to provide you with the best value possible for a swap instead of traders having to manually check across each DEX, which can be time-consuming and ineffective. This is similar to how Google provides you with a compiled list of options for buying something online so you can select the best out of them all rather than searching each, sorting, and deciding on it. The liquidity aggregator’s primary responsibility is quickly determining the best price that any other DEX can provide. Its goal is to protect users from price impact and decrease the probability of failed transactions. Try these Solana trading bots Gmgn , HyperLiquid, Axiom Trade, BullX , MevX , Autosnipe , Dbot , Trojan Bot , Maestro Bot , and BullX . 10 Best Crypto DEX Aggregator GMGN

GMGN is an emerging DEX aggregator designed to streamline DeFi trading and offer users access to multiple liquidity pools at once. By consolidating liquidity from various decentralized exchanges across popular networks, GMGN ensures traders can execute swaps at optimal prices with minimal slippage. Here are some key highlights: Multi-Chain Support Intuitive Interface Low Fees & Slippage Advanced Security Governance & Utility Token Mobile Compatibility (Upcoming)

Visit GMGN BullXBullX is a next-gen DEX aggregator designed for fast, efficient, and cost-effective crypto trading. By aggregating liquidity from leading DEXs like Raydium, Orca, Serum, and Uniswap, BullX ensures the best prices with minimal slippage.

✅ Multi-Chain Support – Trade seamlessly across Solana, Ethereum, Binance Smart Chain (BSC), and Polygon. 💰 Fees: 0.2% per swap + standard network fees

Try BullX MEVXMEVX.io is a next-gen DEX aggregator focused on MEV protection and cross-chain efficiency. Key features include: MEV Resistance: Blocks front-running and sandwich attacks using advanced algorithms, securing high-value trades. Cross-Chain Liquidity: Aggregates liquidity from Ethereum, Solana, BSC, and more for seamless multi-chain swaps. Gas Optimization: Reduces transaction costs by splitting orders and bundling trades across DEXs. Real-Time Analytics: Live slippage predictions, gas fee trackers, and route optimization tools for smarter trades. User-Friendly Dashboard: Simple interface with wallet integrations (MetaMask, Phantom) and a “MEV Shield” toggle. Native Token (MEVX): Earn fee discounts, staking rewards, and governance rights by holding MEVX tokens. Mobile App: Trade on-the-go with iOS/Android apps featuring price alerts and portfolio tracking.

Visit MEVX Now

In the cryptocurrency market, 1Inch Exchange is the top DEX aggregator. It has more liquidity than any DEX and gets it from various liquidity pools and DEXs. The exchange provides 2491 distinct cryptocurrency token pairings. You may purchase these tokens at the lowest possible price with the least slippage. You can utilize the Chi Token, a platform-exclusive token, to lessen the effects of the Ethereum Gas cost. Anyone may trade tokens more easily with the convenience of a smartphone thanks to the exchange’s mobile app, which can be downloaded from the Google Play Store and Apple App Store, respectively. Furthermore, no fees are associated with the exchange for buying, selling, or withdrawing money. Currently, this platform supports four networks, including Ethereum, Polygon, Optimism, and Binance smart chain. In addition, 1Inch supports 16 different wallets, which gives a safe transaction experience on the platform.

Visit 1inch Exchange

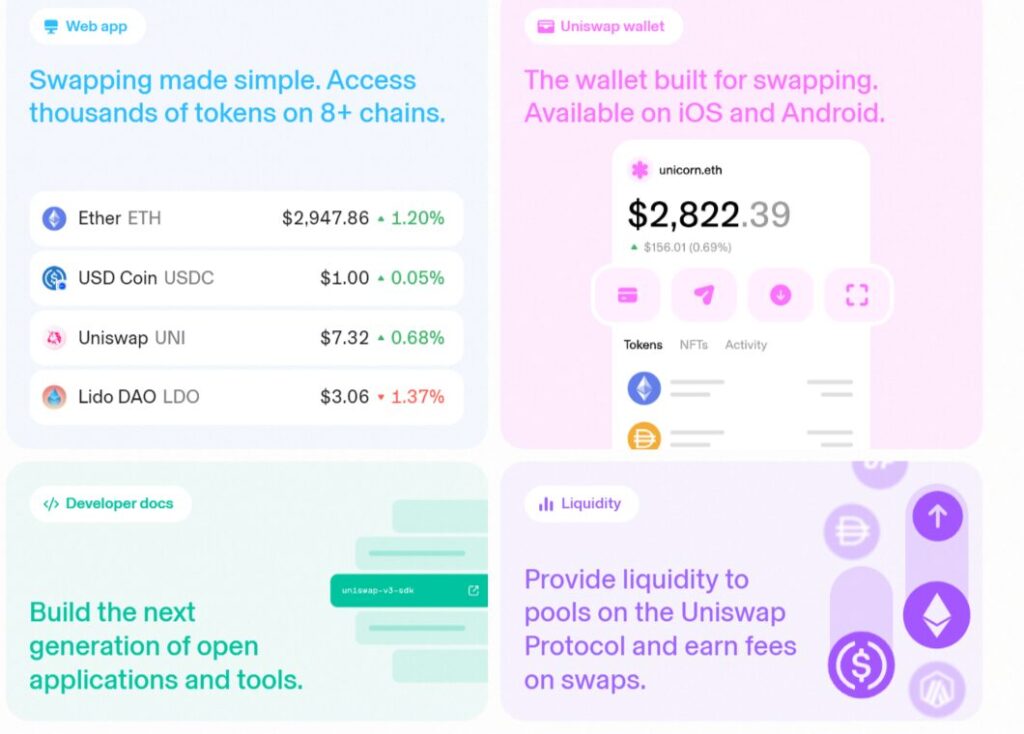

Visit Uniswap Now

Visit Pancakeswap Now

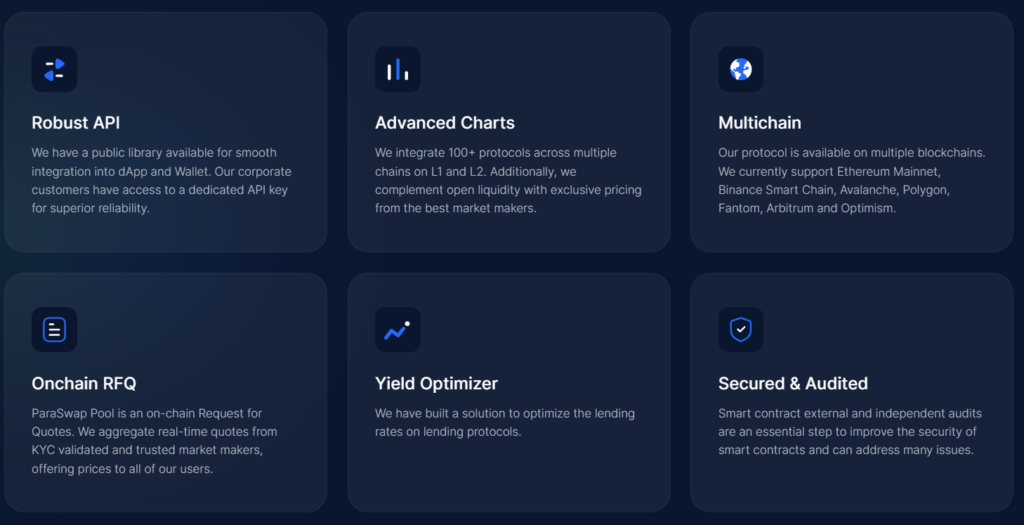

Visit Paraswap Now

Like OpenOcean, Orion Protocol aims to unite all DEXs and CEXs in the crypto-verse. This raises the platform’s total liquidity. Prominent brokers, including Injective, AscendEx, KuCoin, MEXC, etc., are available on the platform. Currently, Ethereum and Binance Smart Chain are the two networks the site supports. Moreover, Orion Protocol enhances transaction security by supporting four distinct wallets, including Trezor and Ledger’s hardware wallets. The platform’s governance is handled by Orion Protocol using an internal token known as ORN. Furthermore, ORN coins may be utilized for liquidity mining and staking. Orion offers a very reasonable price that starts at only 0.25% for trades made via CEXs involving assets other than stablecoins. The platform is launching its app very soon, which you can use.

Visit Orion Protocol Now

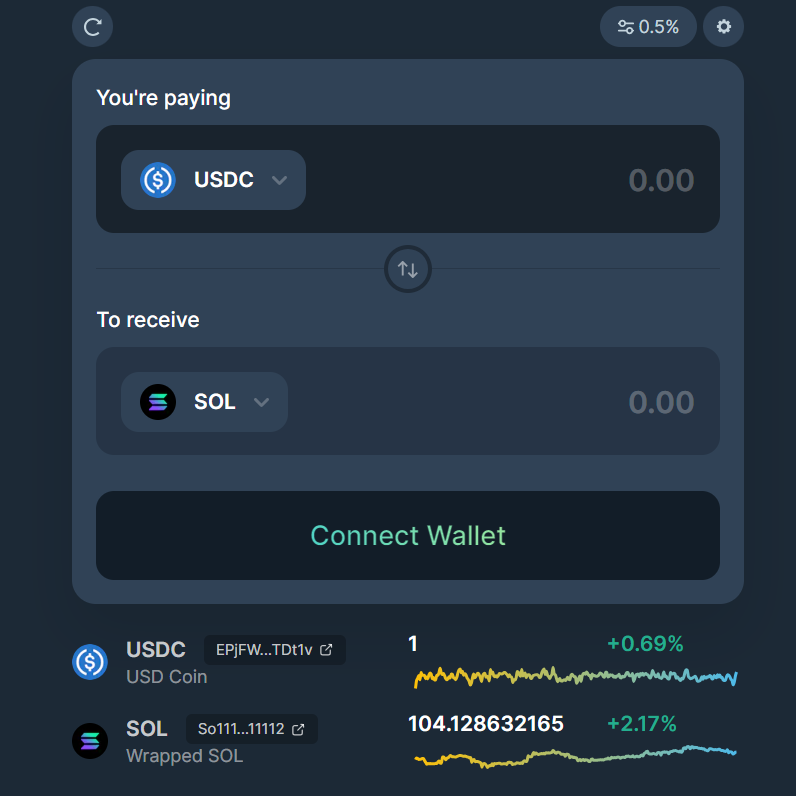

Visit OpenOcean Now

Jupiter is the leading DEX aggregator on the Solana blockchain. It gets liquidity from several Solana DEX, like Raydium and Orca, to mention a couple. At the moment, Jupiter features 605 markets (cryptocurrency trading pairs), 307 cryptocurrencies, and 0 fiat currencies. USDC/USDT is the most traded pair on Jupiter. The foundation of the Jupiter cryptocurrency exchange is the Solana blockchain. It is a decentralized exchange with an AMM foundation founded in 2021. However, the exchange allows users to place a restricted number of orders. Numerous crypto-crypto pairings are available for trading on Jupiter. Jupiter protocol fees don’t exist. Nevertheless, integrator-introduced Jupiter exchange costs can apply to swaps. These costs are expressed in basis points.

Visit Jupiter Now

DEX aggregators, which provide a practical means of obtaining the best prices across several decentralized exchanges, have become a vital tool for cryptocurrency traders. It’s critical to select the aggregator that best fits your trading demands and tastes out of the many possibilities accessible. You may choose the ideal DEX aggregator for your trading needs by considering elements like supported tokens, liquidity sources, and sophisticated features. What separates DEX aggregators from traditional centralized exchanges?

DEX aggregators provide customers direct access to several decentralized exchanges from a single platform, setting them apart from conventional centralized exchanges. Are DeFi exchanges reliable?

Numerous decentralized exchanges have established themselves as trustworthy options for every token trading requirement and desire of their consumers. However, because a lot of secrecy is involved, frauds continue to occur in the sector in large numbers. This is why most people would rather use centralized exchanges, which are a safer option. What are the different types of DEX Aggregators?

Trading aggregation and information aggregation are the two main categories of DEX aggregation. Trading aggregation: These aggregators’ primary function is to compile deals. These give consumers a range of alternatives to select to make the most profitable deal. Aggregation of information: A trader would desire access to better information so they can make more informed judgments. Because most traders rely on data analysis done in real time to predict market moves, information aggregators are essential. (责任编辑:) |